🌧️ This Is Not How It Was Supposed to Go

I had a plan.

I had time.

But storms don’t care about your spreadsheets or your timelines.

The one that hit me this year didn’t come with thunder or flash floods—just wave after wave of real-life chaos: a breakup, a lawsuit, a bankruptcy, and my grandfather getting cancer.

And suddenly, the time I thought I had?

Gone. Washed out. No more flowers in bloom.

🛻 Facing Homelessness (Again)

In just a few weeks, I’ll turn 37. And I’ll be living in my car. Again.

This will be the third time in my adult life I’ve navigated housing insecurity.

I’ve had jobs during all of them. I’ve had family.

But pride is complicated. And burdening others—even those who love me—doesn’t sit well with me.

Some people call it homelessness.

I’m trying to reframe it as radical transition—a detour toward the life I’m trying to build.

But let’s be honest: it’s still terrifying.

💸 The Reality Check

With my grandfather’s health declining, I can’t risk bringing more stress or exposure into his home.

That means carving out a new kind of space: one that doesn’t come with rent or rules, but does require sacrifice.

The idea?

Live in my car.

Cut down every expense I possibly can.

Split my income in half:

- One paycheck goes to bills.

- The other goes straight into a savings fund—a camper-shaped lifeline.

I’m hoping that in a few months, with a little luck and a lot of hustle, I can find a small trailer in the $3,000–6,000 range (and negotiate it down from $10K+). If I can make it work, I’ll park it on my grandfather’s land. That way I can support him—not just emotionally, but financially—and still maintain my own autonomy.

That would be the dream.

Two generations helping each other stay afloat.

📊 Oh How I Love Pie…Charts?

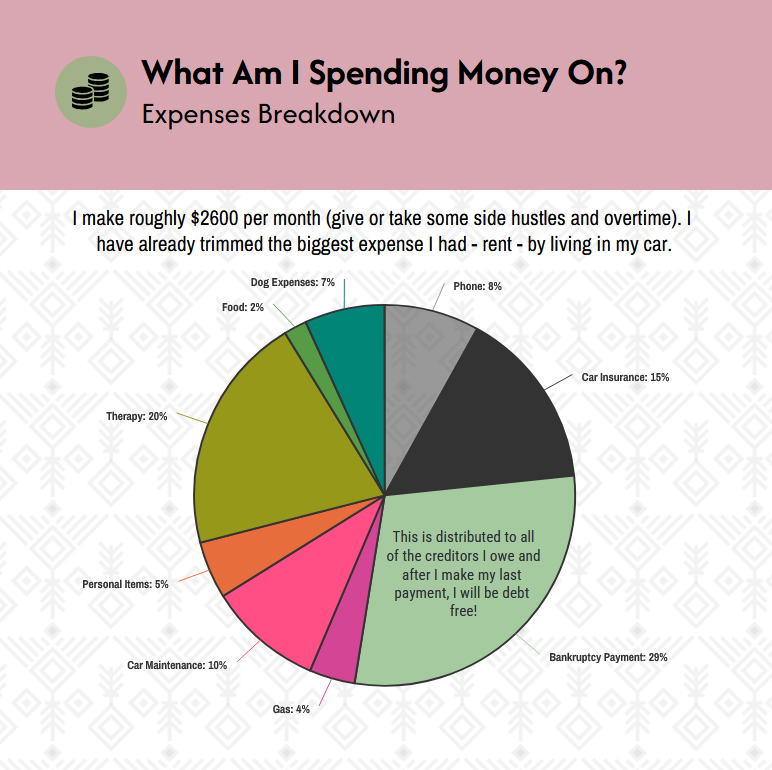

To give you a clearer picture of what living-in-my-car budgeting looks like, here’s a snapshot of where my money goes each month. I bring in roughly $2,600 (give or take some side gigs and overtime), and I’ve already cut the biggest expense most people carry—rent. What’s left gets carefully split across the bare essentials: therapy (because mental health is survival), car insurance, maintenance, gas, a few small bills, and my bankruptcy payments—which take up nearly a third of my income but will eventually lead me to being debt-free. It’s tight, but it’s honest. And this breakdown is part of how I’m keeping myself grounded while everything else is in motion.

It accounts for about 68% of that $2600 so that gives me 42% to put into savings (a little over $1000 or $500 per paycheck). Since I want to have about $6000 at the low end by December, I need to come up with a way to make an extra $2000 in 4 months. So that means I am going to have to get back into those side hustles and I am hoping that’s leaning heavy into my jewelry business and also selling things I do not need from my apartment.

🌱 Trying to Grow Something New (Again)

It feels like every time I plant seeds, a drought hits.

Or a swarm of insects comes and tears it all down before anything gets the chance to bloom.

But here I am—planting anyway.

This blog, this plan, this moment…

they’re all tiny acts of resistance.

Of faith.

Of choosing growth even when the ground feels dry.

I don’t know if the rain is coming.

But I’ve learned that sometimes, you water your own roots with hope—and that has to be enough.

Here’s to finding sunshine, even when it’s filtered through the windshield of a car.

Here’s to growing wild, even in cracked soil.

Here’s to blooming again, and again, and again.